Tax increases on wealthiest, budget reserves key pieces of Walz's budget proposal

The first pawn in a months-long budgetary game of chess has been played.

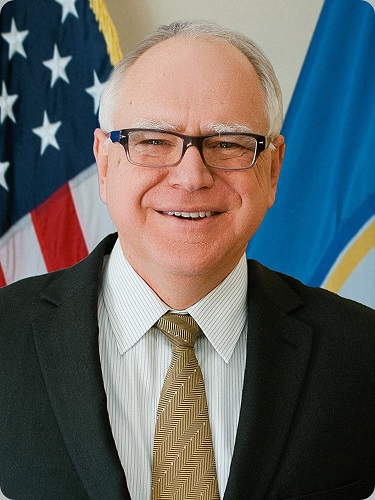

Calling it the “Minnesota’s COVID-19 Recovery Budget,” Gov. Tim Walz unveiled his $52.4 billion 2022-23 budget proposal Tuesday, that includes tax increases on the wealthiest Minnesotans and big corporations, further assistance for struggling smaller businesses, help for students falling behind and dipping into the state’s budget reserve.

“We know that when workers are supported, when children are supported, when quality of life is supported, it creates an economic environment where things thrive,” Walz said. “We’re going to ask those that are most fortunate and those corporations that have profited during this time to pay a fair share to make sure we can continue to provide the services we need.

“… It will take in the realities of where we’re at with COVID-19, it’s fair in how it impacts people, and it does the things that I’ve said I would do: a responsible budget to make sure we leave this state in good shape for future generations.”

Jim Schowalter, commissioner of Minnesota Management and Budget, said the $1.3 billion in new spending is offset by $150 million in budget reductions and use of carryover funds. The proposal also uses $1 billion of the state’s budget reserve (leaving $847 million) and $130 million from the stadium reserve fund which is used to pay bonds on the $1.1 billion U.S. Bank Stadium.

The stadium reserve would still have $100 million; something Schowalter said would be “more than enough to handle any unexpected reductions in revenue.”

[MORE: Summary of recommended changes by agency, proposed General Fund and non-General Fund changes]

The budget would leave $470 million on the bottom line.

“We could have solved our budget hole by using reserves and savings and balances, but that would have left tremendous needs in education, for helping families in need and businesses struggling to survive,” Schowalter said.

Unsurprisingly, reactions from House leaders varied.

“Governor Walz’s budget reflects the values of Minnesotans and incorporates the reality that COVID-19 has hit some people and businesses harder than others,” House Speaker Melissa Hortman (DFL-Brooklyn Park) said in a statement. “… We can and should use the budget to invest in Minnesota and in Minnesotans to ensure economic opportunity for everyone.”

“We need strong economic growth, we have to grow our way out of this recession. There is no other way and, unfortunately, all the things the governor is putting in place will hinder economic growth,” said House Minority Leader Kurt Daudt (R-Crown).

A number of House committees and divisions plan to start reviewing the governor’s plan this week. The heavy lifting is not expected to take place until March after the next budget forecast is released late next month.

The state’s latest budget forecast projects a $1.3 billion shortfall for the upcoming biennium, however, that mark was announced Dec. 1. Since then the Legislature has passed a law providing financial assistance for small businesses and more federal dollars have entered state coffers.

State law requires a balanced budget each biennium; therefore, Walz and the Legislature must come to an agreement by May 17, the constitutional last day of the 2021 legislative session, otherwise the recent custom of budget-setting special sessions — five times since 2010 and eight times since 2001 — would again be needed.

If no agreement is reached by July 1, 2021 — the start of fiscal year 2022 — a partial or total state government shutdown would occur.

What Walz wants

The governor’s proposal invests $745 million in new E-12 education spending. “(This is to) respond to the pandemic’s impact on students by expanding extensive summer learning programs in and outside of classrooms to help students catch up on learning,” Schowalter said.

In addition to $300 million to increase the per-pupil funding formula by 1% in fiscal year 2022 and 2.5% in fiscal year 2023, the budget calls for $46 million over the biennium, and let schools hire more student support services personnel to meet students' social, emotional and physical health needs.

Other initiatives for the upcoming biennium include:

- $235 million to establish a paid family medical leave program;

- $157 million to support small businesses impacted by the pandemic through emergency loans;

- $150 million to support rebuilding efforts for small businesses and other private property in Minneapolis and St. Paul damaged last year in riots after the death of George Floyd;

- $50 million in investments in the border-to-border broadband grant program;

- $50 million in forgivable loans to help cultural, entertainment and hospitality industry businesses hardest hit by COVID-19;

- $35 million in workforce stabilization grants to provide tuition-free access to a public or tribal college for workers impacted by COVID-19;

- $20 million in one-time funding for 4- and 5-year-old students to attend a star-rated public or private preschool or pre-kindergarten in-person learning program at no cost;

- $1.3 million increase in Emergency Assistance grants to help alleviate temporary financial hardships for thousands of college students, and

- a one-time $750 payment to families in the Minnesota Family Investment Program.

Taxes go up, taxes go down

The plan calls for income tax increases for the wealthiest Minnesotans, a capital gains tax increase, a corporate tax increase, an estate tax increase and an increase in the cigarette tax.

Framing the new fifth tier as "1 percent on the 1 percent,” Walz is calling for an income tax increase for top earners — including married couples making more than $1 million or a single earner netting $500,000.

“If your family is making less than $20,000 per week, this isn’t going to hit you,” Walz said while reiterating numerous times that 99.3% of Minnesotans would not be negatively affected by the change.

The budget also calls for a $1 tax increase on a pack of cigarettes with a correlating moist snuff increase along with a new gross receipts tax on sales of vaping products, changes that Daudt called “hugely regressive” because they’ll affect low-income Minnesotans hardest.

“Thank God Republicans have the majority in the Senate,” said Senate Majority Leader Paul Gazelka (R-East Gull Lake). “… We do not need to raise taxes on anyone. That’s a line in the sand.”

However, not all proposed tax changes are increases.

For example, Walz seeks to expand the Working Family Credit for more than 300,000 eligible Minnesota households, which would result in an additional $160 per home.

The governor’s budget plan would also invest $95 million by expanding the first-tier individual income tax bracket and cutting taxes for more than 1 million households.

Related Articles

Search Session Daily

Advanced Search OptionsPriority Dailies

Ways and Means Committee OKs proposed $512 million supplemental budget on party-line vote

By Mike Cook Meeting more needs or fiscal irresponsibility is one way to sum up the differences among the two parties on a supplemental spending package a year after a $72 billion state budg...

Meeting more needs or fiscal irresponsibility is one way to sum up the differences among the two parties on a supplemental spending package a year after a $72 billion state budg...

Minnesota’s projected budget surplus balloons to $3.7 billion, but fiscal pressure still looms

By Rob Hubbard Just as Minnesota has experienced a warmer winter than usual, so has the state’s budget outlook warmed over the past few months.

On Thursday, Minnesota Management and Budget...

Just as Minnesota has experienced a warmer winter than usual, so has the state’s budget outlook warmed over the past few months.

On Thursday, Minnesota Management and Budget...